COMMITED TO PROVIDE FINANCING SOLUTIONS TO SMALL & MEDIUM ENTERPRISE BUSINESSES

NGO & Trust Registration – Empower Your Mission, Legalize Your Impact!

Get Legal Recognition & Access to Funding. Register Your NGO or Trust Today!

Why Register an NGO or Trust?

In today’s world, NGOs and Trusts play a crucial role in addressing social, environmental, and humanitarian issues. However, to operate legally, gain credibility, and access various benefits, registering an NGO or Trust is essential. Whether you aim to work for education, healthcare, poverty alleviation, or any other noble cause, having a legally registered organization ensures that your efforts are recognized and supported. Registering an NGO (Non-Governmental Organization) or Trust is essential for ensuring credibility, legal recognition, and access to financial benefits that help in achieving your social objectives effectively.

Why NGO - Trust Registration is Necessary?

Legal Recognition & Protection

A registered NGO or Trust gains official legal status, making it a separate entity from its founders. This allows the organization to:

✔️ Operate independently and have a structured governance system.

✔️ Own property, open bank accounts, and sign legal contracts.

✔️ Secure long-term stability and legal protection against conflicts.

Without legal registration, your organization may face operational challenges and limitations in securing funding or partnerships.

Tax Exemptions & Financial Benefits

Registered NGOs and Trusts are eligible for various tax exemptions, reducing their financial burden and encouraging donations. Key tax benefits include:

✔️ 12A Registration – Exempts the NGO’s income from tax.

✔️ 80G Certification – Provides tax benefits to donors, encouraging contributions.

✔️ FCRA Registration – Allows NGOs to receive foreign donations legally.

These exemptions help organizations save funds and allocate more resources toward social welfare activities.

Access to Government & Corporate Funding

Most government schemes, grants, and subsidies are only available to registered NGOs and Trusts. Registration also allows access to CSR (Corporate Social Responsibility) funds from private companies. Benefits include:

✔️ Eligibility for government funding programs.

✔️ Ability to apply for corporate donations and partnerships.

✔️ Increased trust from global organizations for international funding.

Without proper registration, NGOs miss out on significant financial aid that can help them expand their reach.

Increased Credibility & Public Trust

A registered NGO or Trust earns the trust of donors, volunteers, and the public. It shows that the organization operates transparently and ethically, which leads to:

✔️ More donors willing to support the cause.

✔️ Higher chances of securing collaborations and partnerships.

✔️ A strong reputation that helps attract volunteers and beneficiaries.

Registration ensures that people see your organization as genuine, accountable, and legally compliant.

Smooth Banking & Fundraising Operations

A registered NGO or Trust can legally open a bank account in its name, making financial transactions transparent and credible. Other benefits include:

✔️ The ability to receive domestic and international donations.

✔️ Simplified financial management with structured accounting.

✔️ Increased chances of getting loans or financial aid.

Most financial institutions require an NGO or Trust to be officially registered before offering any banking services.

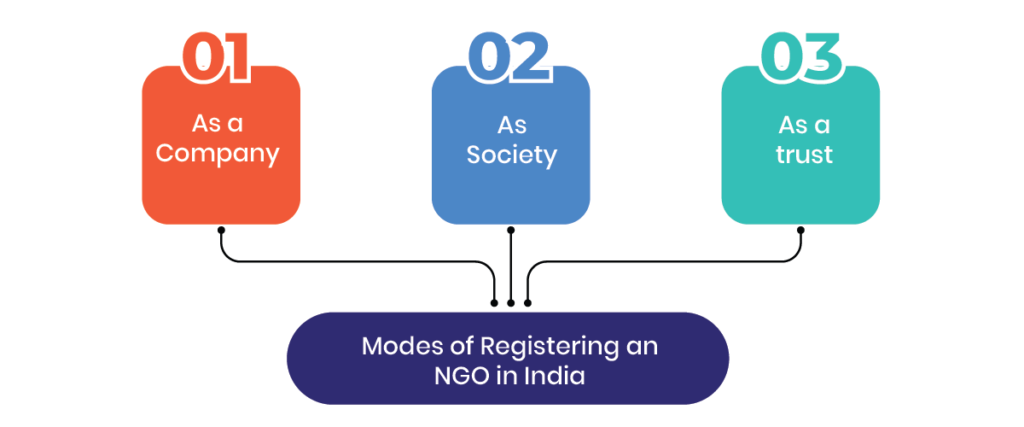

Mode of Registration NGO & TRUST

Required Documents for NGO - Trust Registration in India with US

Gather the necessary documents: You will need to provide the necessary documents required for trust registration. The list of required documents includes:

- Identity proof of trustees

- Address proof of trustees

- Trustee photos needed for registration.

- Stamp paper needed for trust deed.

- NOC from the owner of the property where the registered office of the trust is located

- Proof of ownership of the property

- Trustees and trust need PAN.

- Bank statement of the trust.

Take the First Step Today!

Registering your NGO or Trust opens the door to credibility, funding, and long-term growth. Don’t let legal barriers hold you back—get registered today and make a lasting impact!

Frequently Asked Questions (FAQs)

Can I start an NGO alone ?

Yes, but for Trusts and Societies, at least two members are required.

What is the difference between a Trust, Society, and Section 8 Company ?

A Trust is managed by trustees, a Society by a governing body, and a Section 8 Company by a board of directors.

How long does it take to register an NGO ?

NGO registration typically takes 15-30 days, depending on government processing.

Can my NGO get government funding ?

Yes, registered NGOs are eligible for government and international grants.

Is tax exemption available for NGOs ?

Yes, NGOs can apply for 80G & 12A tax exemptions to benefit from tax-free donations.

How long does it take to registrer a NGO-TRUST in india ?

The registration process can take up to 15-20 days, but Legal Dev offers an efficient and streamlined process to ensure quick registration.

About US

GST & Loan is wide range of CA & CS services we offer for your Business Legal Advisor.

Quick Links

Our Services

GST Registration & Filing

All Type Registrations

Business & Personal Loans

Financial Advisory

Contact Us

Email : info@gstloan.com

Phone : 9015226577 , 9718222400

Head Office 1

First Floor,Ganpati Tower, Near Rawat Motors,Peeragarhi – 110087

Head Office 2

Shop No-817, Gali No-17, Near Dum Dum Metro Station, W.B. – 700030